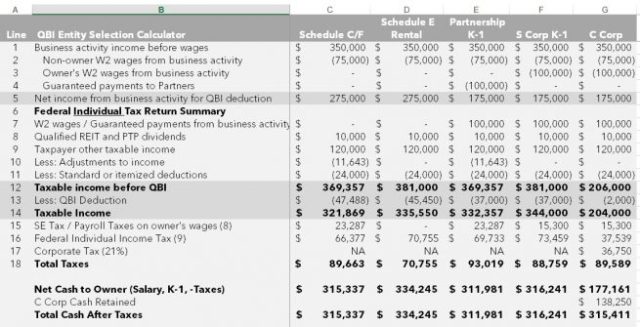

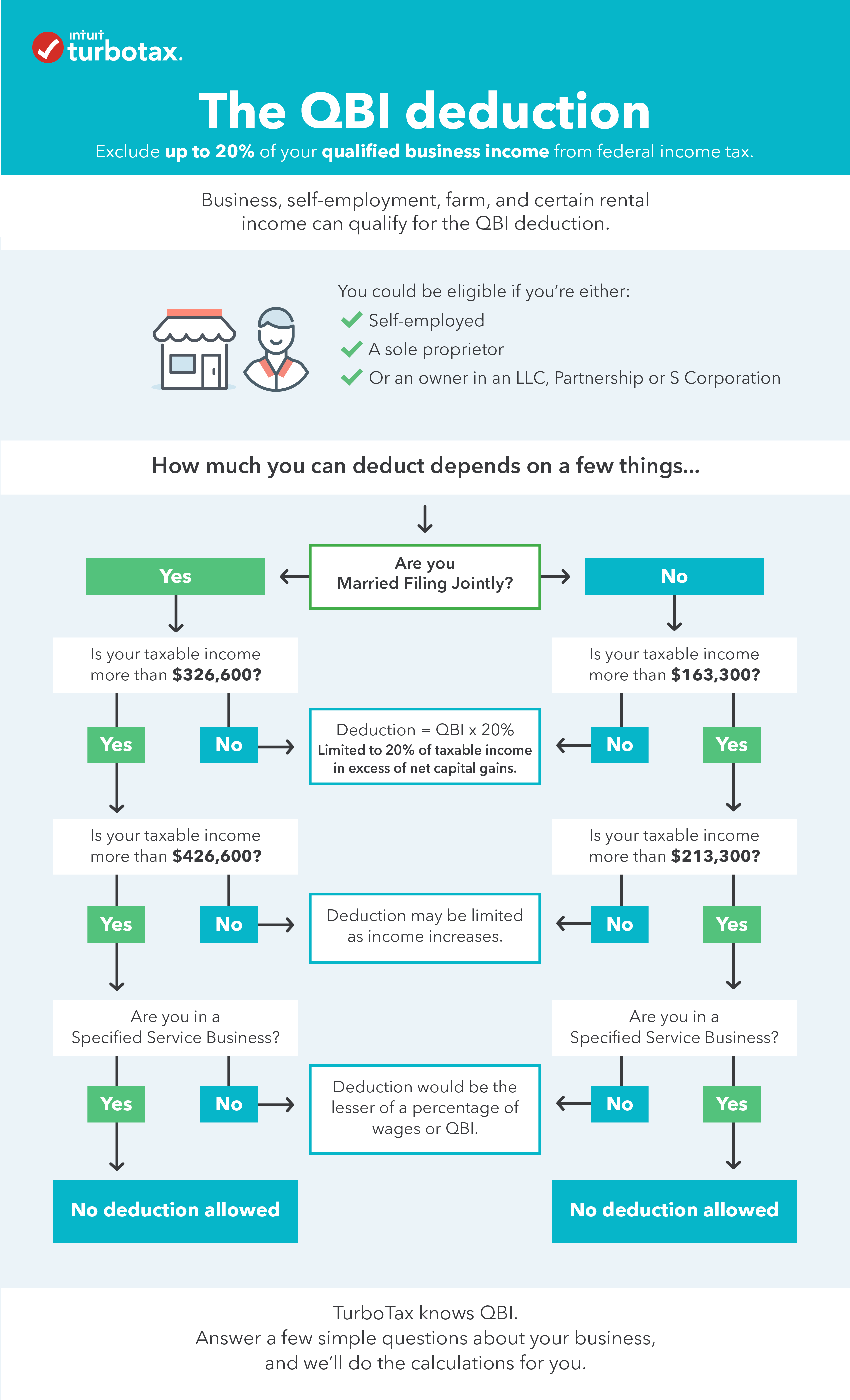

(How to Calculate the 20% 199A QBI Deduction) - Very Detailed (20% Business Tax Deduction Explained) - YouTube

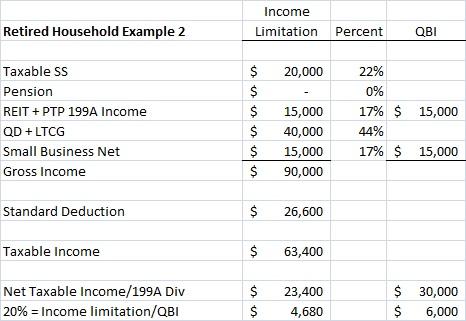

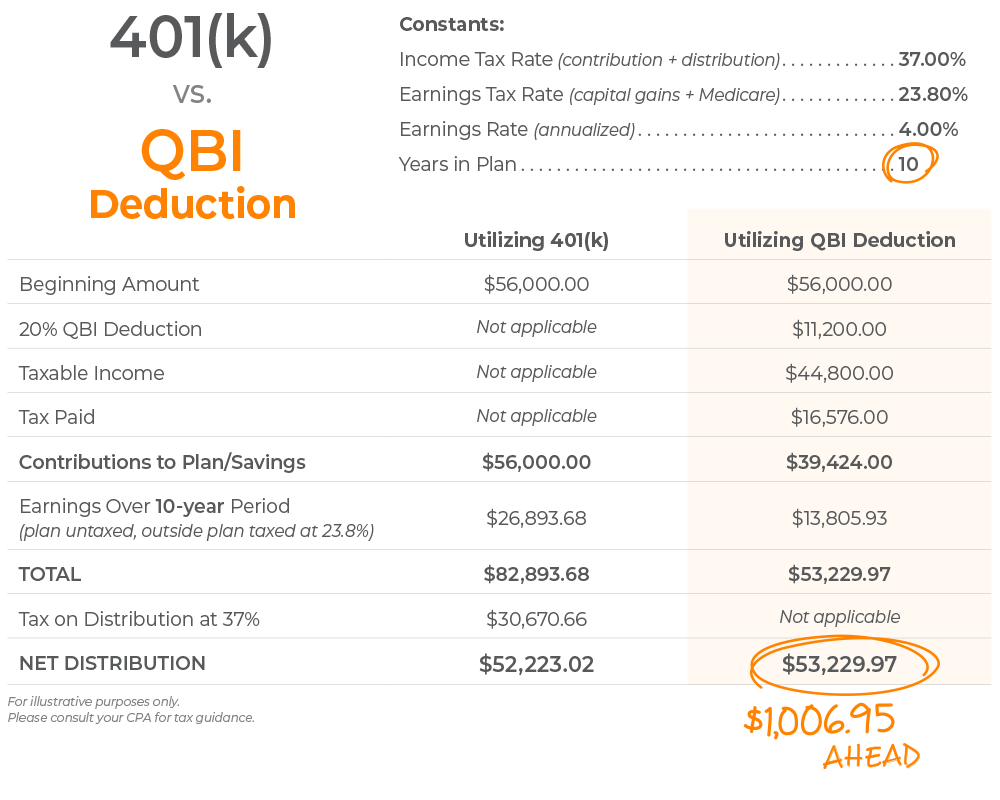

Calculator Helps Lawyers Determine Qualified Business Income/Pass-Through Business Income Deduction Under New Tax Law - Montage Legal Group