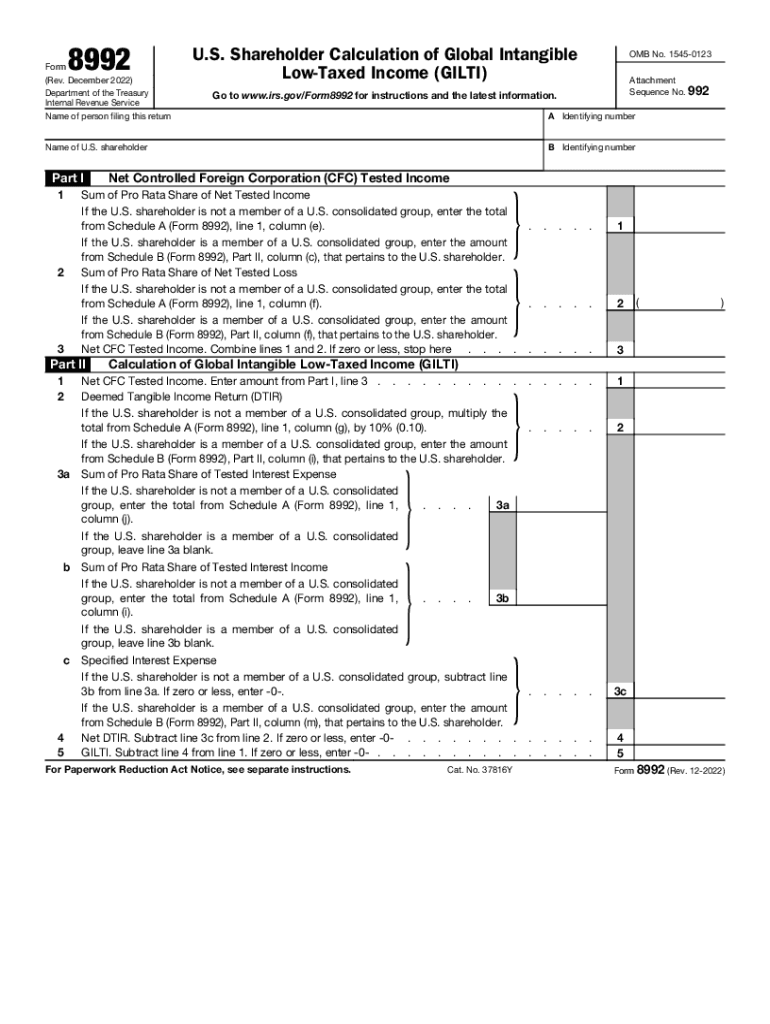

Form 8992 (Rev. December 2022). U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI): Fill out & sign online | DocHub

Understanding How to Compute a U.S. shareholder's GILTI inclusion | Foodman CPAs & Advisors - JDSupra

Understanding How to Compute a U.S. shareholder's GILTI inclusion | Foodman CPAs & Advisors - JDSupra