Teine Energy Ltd. Closes on a USD $300 Million Senior Secured Second Lien Term Loan and Refinances Revolving Credit Facility

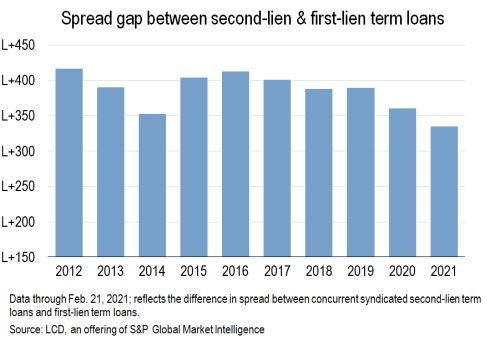

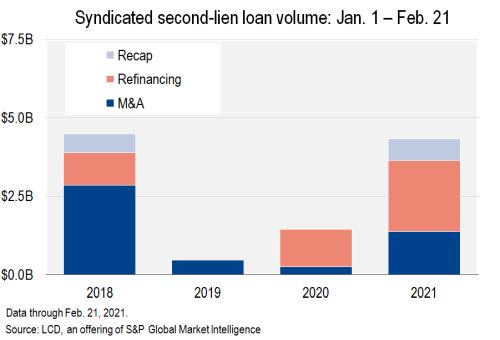

Second-lien resurgence reflects risk-on wave in leveraged loan market | S&P Global Market Intelligence

Second-lien resurgence reflects risk-on wave in leveraged loan market | S&P Global Market Intelligence

Second-lien resurgence reflects risk-on wave in leveraged loan market | S&P Global Market Intelligence

Second-lien resurgence reflects risk-on wave in leveraged loan market | S&P Global Market Intelligence

:max_bytes(150000):strip_icc()/final_secondleindebt_definition_1101-ff57e32ffe264dae9ab9357e202acd8c.png)